Sachet Loans seem to be positively correlated to business growth, for every 1% increase in Sachet Loan borrowing, businesses saw sales grow by 0.5%

While Sachet Loan value increased by 43% from 2020, volumes decreased by 19% since 2021 because of stringent lending rules

The trend of early end of season sale has given rise to the demand for Sachet Loans among D2C brands showed Instamojo’s latest #D2CDecoded Report. Between August 2022 to July 2023, D2C brands borrowed more than INR 243 crore worth of sachet loans, a 43% increase from the same period in 2019-2020.

Sachet Loans, a service first introduced by Instamojo in 2020, are small ticket cash advance loans which a business takes to manage its liquidity during high demand periods. Sachet Loans saw a peak during the pandemic with businesses borrowing a total of INR 252 crores during the 2020-21 period. However, with the growing number of end of season sales, the demand for these sachet loans seem to have persisted.

Here are some interesting insights on Sachet Loan disbursement trends from the second edition of Instamojo’s #D2CDecoded Report:

Sachet Loans has become the new normal post-COVID for D2C brands, recording a growth of 43% since 2019-20

Sachet Loans saw a massive spike of 48% between 2020 and 2021 due to rising liquidity crunch and demand during the pandemic

However, because of the advantages of Sachet Loans, the demand for them has remained since 2021 dropping only slightly by 3% between 2021 and 2023

While the total value of Sachet Loans is on the rise, the volume seems to be decreasing with stringent rules on disbursements. Sachet loan disbursement volume decreased by about 19% since 2021

Early End of Season Sales drive growth of Sachet Loans contributing to over 40% of overall loan disbursement volumes

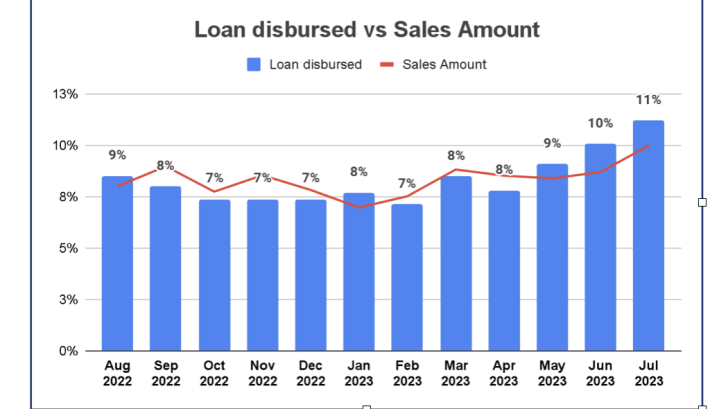

Almost 40% of all loans disbursed were during April to July period which corresponds to the early end of season sales launched by e-commerce and D2C brands in India

However, this is a new trend. Between August 2021 and July 2022, there were only two spikes in sachet loan disbursements during Dec-Jan, and Mar-Apr which correspond to the festive season and end of winter sales. However, to counter the lowering demand this year D2C brands borrowed to give heavy discounts on their products as part of early send of seasons sales

There is a positive correlation between Sachet Loans and Business Growth. For every 1% increase in Sachet Loan borrowing, businesses saw sales grow by 0.5%

The positive correlation between Sachet Loans and Business Growth

Sachet Loans seems to be becoming more and more important for business growth for the D2C brand. According to our analysis for every 1% increase in Sachet Loan borrowing, there is a 0.5% increase in sales for D2C brands.

Education and Jobs related D2C companies took out the largest share of Sachet Loans at 53%

There was a 100% repayment rate for Sachet Loans among D2C brands showing it is more impactful than mid-term personal loans

About Instamojo

It’s 2023, we are not a payments’ gateway company. Instamojo is THE one-stop #D2CTech company,offering an enabling platform for MSMEs and D2C brands, empowering sellers to start, scale, and manage their businesses online. Since its inception in 2012, Instamojo has ably addressed and resolved the last mile needs of its customers, having enabled million+ MSMEs’ custodians. Founded by Sampad Swain, Akash Gehani, and Aditya Sengupta, Instamojo fuels India’s entrepreneurial passionwith a continued commitment as a one-stop-solutionfor business owners. It has raised Series B (2020) and Series A (2014) funding from Kalaari Capital, Blume Ventures, 500Startups, Gunosy Capital, and AnyPay – a Japanese payments firm. Instamojo is all set to reshape the future discourse in the D2C space by catering to diverse seller needs, powered by the collective force of technology, data and design.